Table of Contents

Introduction – My $500 Lesson

I still remember the day I lost $500 worth of crypto. It was a simple mistake: I kept all my coins in a hot wallet—quick and easy for daily use—but it wasn’t secure. One phishing link later, poof—gone.

That painful experience taught me a lesson: hot wallets are convenient, but not for serious money. In this guide, I’ll compare hot wallets and cold wallets, explain why hot wallets cost me—and what you should never do.

What Is a Hot Wallet?

A hot wallet is any crypto wallet connected to the internet—mobile apps, browser extensions, or exchange wallets (like MetaMask, Trust Wallet, Coinbase).

They’re great for:

- Fast, frequent transactions

- Trading, NFT interactions, DeFi apps

- Beginner-friendly design

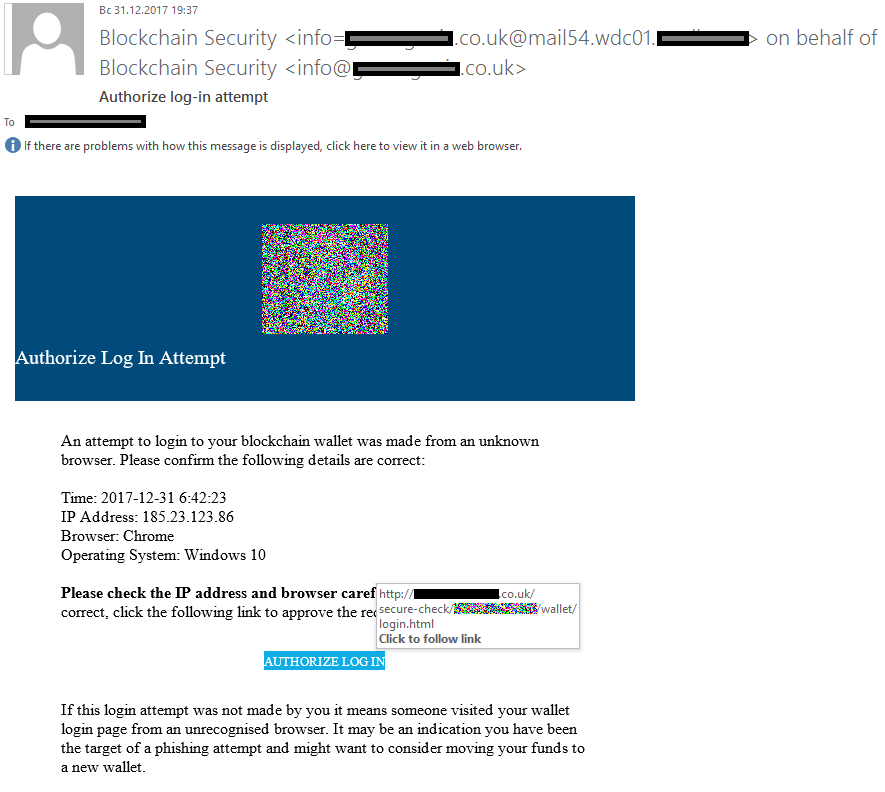

But they’re vulnerable: phishing, malware, hacked exchanges—all can drain your funds instantly.

What Is a Cold Wallet?

A cold wallet (hardware or paper wallet) keeps your private keys completely offline—a physical device or printed code you store securely.

Cold wallets provide:

- Full offline security

- Self-custody (you control the keys)

- Protection from online phishing and hacks

📉My Mistake: Why I Lost $500 in a Hot Wallet

I clicked a fake email link appearing to be from a trusted crypto platform. Suddenly I was signed out, and when I logged back in—my balance was zero.

Statistics show:

Hackers have stolen over $7 billion from crypto wallets since 2022, according to combined data from TRM Labs, Reuters, and BTCC. These losses include phishing attacks, exchange breaches, and vulnerabilities in hot wallets—affecting both individuals and institutions.

The WazirX hack in mid-2024 led to losses of $234 million — via social engineering and exploiting multisig processes.That’s when I realized: hot wallets are fine for small amounts, but not for anything you can’t afford to lose.

Hot Wallet vs Cold Wallet: Side-by-Side Comparison

| Feature | Hot Wallet | Cold Wallet |

|---|---|---|

| Internet Connection | Required (always online) | Not required (offline) |

| Security Level | Lower (vulnerable to hacks) | Higher (immune to online threats) |

| Ease of Use | Very easy, fast access | Requires physical access, setup |

| Best Use Case | Daily spending, small holdings | Long-term storage, large funds |

| Cost | Usually free | $50–$200 (hardware cost) |

| Recovery Method | Email/password reset | Seed phrase only (no reset) |

🤝The Hybrid Strategy (Best of Both Worlds)

Many experts (like TokenMetrics and BizTechCommunity) recommend a hybrid strategy:

- Keep small balance (< $100) in a hot wallet for spending and dApps

- Store the rest in a cold wallet for long-term safety

That’s what I did after losing my $500—and it stopped the fear.

Final Thoughts: What You Should Do Today

- Never store all your crypto in a hot wallet. That’s what got me.

- Use a trusted cold wallet (Ledger, Trezor, Keystone, etc.) for long-term holdings.

- Maintain a small amount in a hot wallet for daily use or DeFi.

- Always enable 2FA, verify all links before clicking, and never reveal your seed phrase.

References

- TRM Labs hack data and industry trends: Zendwallet Blog, BitGo, IntelligentHQ

- Hot wallet risks and phishing vulnerabilities: Wikipedia, CoinStats, ResearchGate

- WazirX 2024 multisig cold wallet exploit of $234M: Wikipedia

- Expert wallet comparisons & strategy guides: TokenMetrics, BizTechCommunity, Mineatech